Ugh, Financial Modelling - Part One

What are all those numbers?

Looking at financials is intimidating.

Being asked to build financials is a whole other level of intimidating.

When we’re creating social enterprises, the top priority is to make a positive difference in the world.

Spreadsheets are low priorities, for good reason. If they’re not done properly, they are boring, cryptic, vague and often complete works of fiction.

Worse still, even if you had an accountant or robot prepare a set of financials for you, they probably wouldn’t change your behaviour one bit.

That’s because spreadsheets don’t make decisions for you. All they do is tell you about the gaps between different numbers.

What is a financial model?

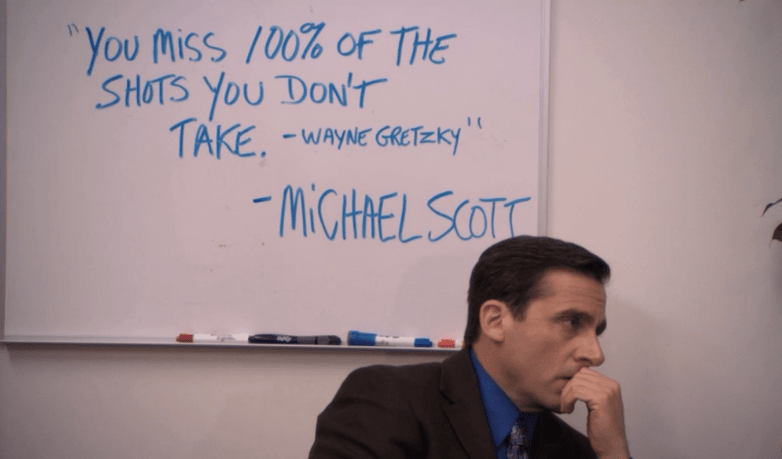

A financial model tests the question:

“If we ran our enterprise like this, can we stay in business?”

You create a scenario e.g. We will sell this many products, at these prices, pay a few staff, rent out a warehouse and create this much social impact.

The model then calculates everything, and tells you whether or not that exact scenario will make money or lose money.

Then, depending on how you feel about the answer, you change the scenario slightly.

What if we sold another product too? What if we hire more people? What if we spend more on marketing?

The model tells you about what difference those adjustments would make.

You might like what it tells you, or you might not. Either way, you can’t ignore it.

Why do I need a financial model?

You’re looking to cover your butt. If there’s a flaw in your plan, and it costs $5 to make a $4 coffee, you need to know that as early as possible, ideally before you sink any money into the business.

As entrepreneurs, your mind is prone to wander and think of new possibilities, which is a huge strength. A financial model allows you to see what each possibility would mean for your enterprise.

That means you (and your team or board) get to sit down, examine the options and say

“Which of these four options do we want to take?”

This gives you the best chance of success, or put another way, the best chance of avoiding disaster.

By all means, make risky decisions. Calculated risk is a good thing. Going in blind is not.

What are the building blocks of a financial model?

It looks like this:

Income – Cost of Goods Sold – Fixed Costs = Profit (or loss)

In other words:

List how much we earn selling products

Minus the cost of us buying each of those products or raw ingredients

Minus the expenses that we have to pay no matter how much we sell

Equals the amount left over, or the amount we’re short.

As you can imagine, this requires a lot of guessing.

You’re guessing about how much customers are willing to pay, how many items you’ll sell per month, how much you’ll pay in rent and wages, how much your utilities (water, electricity, internet) will cost, and how fast your enterprise will grow.

The model is your chance to list all of the guesses, so that you keep track of them.

There’s a great term called Source Amnesia, which is when you know something to be a fact, without remembering where you heard it. This is dangerous when the “fact” was a guess you heard someone make, or a prediction, or something featured in The Simpsons.

I was embarrassed to learn that "Guys and Dolls" doesn't have a song called "Guys and Dolls"

In your head, they all blend into “The Truth”. By listing all of your assumptions and guesses, it keeps a record of which ones have been confirmed, and which ones were rough figures you put in as placeholders.

Why does my model look so complicated?

Because running a business is complicated. As an entrepreneur, you need to have an intuitive sense for how much things cost, how sales are tracking, and whether or not things are going well. That gut feel is what keeps you alive – you’re able to make lots of small changes and adjustments in order to improve your chances of success.

The question of “How much income will we earn” is tricky, because it depends on a lot of different things. Your model lists them all – number of customers, average amount they spend, price of each item, how often they come back, what times of the year are busiest, etc.

It takes a lot of effort to work out how much you’ll earn.

There are no shortcuts.

It is worth doing the work.

Costs are even longer, because there are so many things a business pays for.

It’s easy to think of ones like wages, buying ingredients, rent and equipment.

It’s easy to forget things like insurance, payroll taxes, registration fees, and maintenance.

Please don’t feel put off by all of this. Please don’t treat this as homework you’re doing for someone else.

The model is a favour for you. This is entirely in your interest, as it makes your life so much easier (eventually).

Ante Mortem

What would it take to knock over your business? What’s the least amount that can go wrong for it to collapse?

A Post Mortem is where you learned what killed something. Important, but too late.

An Ante Mortem is where you speculate about what could kill something, and it’s a great way to spot the weaknesses of your plan.

The human mind is excellent at bringing down ideas. Use that force to protect yourself, by finding weak points and reinforcing them.

For financials, you can do a scenario test: What happens if there’s a 10% drop in sales? 20%? 30%?

I once did this for a social enterprise in Port Douglas, a yacht that took tourists snorkelling in the Great Barrier Reef.

We needed to know how many tickets we had to sell in order to break even. By building the model (about 30 versions) and making adjustments to the business, it got down as low as 40% of tickets to break even.

That’s good news for an investor – even if a cyclone hits the boat, we have a high margin of safety. I distinctly remember an argument I had with a fund manager over the number of bad weather days we’d factored in. It felt petty, but the figures mattered.

Sure enough, the boat was hit by a cyclone.

Twice.

The model was right. Even being out of the water for a few weeks, the financials were ok.

That’s what helps you sleep at night – the knowledge that you can survive a shock or disaster.

Limitations

Just because you made a guess doesn’t make it true. You need to go and validate your assumptions, even if you don’t like what you find.

A good model can still fail. The enterprise in Port Douglas was financially strong, and it still collapsed because of the management team.

Financials aren’t bulletproof, and they don’t have to be your favourite thing to do.

It’s worth doing them to put your mind at ease, and to remove the dread that comes from opening an Excel file.

The best thing you can do is to start – make a list, even if it’s ugly.

Write out your guesses about income and expenses, and see how much you have left over.

You’ll probably be surprised, then start adjusting and building version two.

Up next in Part Two, why you should care about your financial model...

You can go straight to:

Part One: What is a Financial Model?

Part Two: What does a Financial Model do for me?

Part Three: Building the skeleton of the Model

art Four: Tips & Traps