Choosing Your Portfolio Of Projects

Starting and growing a remarkable business isn’t one task – it’s a million potential tasks that each demand your time and attention.

Any founder who wants to build a sustainable business will need to form an opinion on what “portfolio of projects” they want to complete, in order to make progress and avoid going bankrupt.

But how do you choose what to say “Yes” to and what to knock back?

The answer might lie in a very odd analogy…

The Monkey And The Podium

Obi Felten has this incredible question she asks entrepreneurs, which I’ll paraphrase here:

Let’s say you want to become a busker, and you’ve decided that your act will involve a specially trained monkey, standing on a marble podium, reciting the works of William Shakespeare.

It’s an eccentric dream, but it’s your dream!

Which do you want to do first: train the monkey or build the podium?

I’ve been using this ridiculous question for four years now, and I am more and more impressed at how powerful it is.

It splits most rooms 60-40.

40% say “Build the podium”, for a few reasons:

· It is straightforward

· You can learn how to sculpt marble on the internet

· You can split it into 20 smaller tasks and knock them off one by one

· You end up with an asset that can be sold (once)

· You will have visible progress each week

· They don’t know the first thing about monkey training

· What if you can’t train the monkey?

60% say “Train the monkey”, for a few reasons:

· Without the monkey, you have no act

· The monkey is the hard part

· The monkey is the remarkable part

· The monkey is the act, which can generate money over and over again

· You’ll be the first person in history to do this well

Both good answers, but one is stronger than the other: training the monkey is the right move, because of what happens if you can’t have both things.

No podium? No problem, you still have an act.

No monkey? No business, you don’t have anything particularly remarkable.

The lesson from Obi Felten is to do the hard part or the unknown part first.

And in most new businesses, the founder instantly knows which part is their monkey and which part is their podium.

Money Can Be Lumpy

Having worked with nearly a thousand businesses, I’ve seen that most businesses don’t earn their money evenly throughout the week or the year.

For most companies, their work can be divided into three buckets:

Cash Cows – where you make a significant margin.

Small Margins – where you cover your costs with a bit left over.

Loss Leaders – where you make little to no money but gain valuable credibility, customers or make a positive impact.

To be clear, I love all three of these, and using a combination gives you freedom.

Overdoing any one bucket can spell trouble, it limits your work and your pricing, and can cause you to run out of money.

What we want is a sustainable balance, where the margin-making work slightly outweighs the little-to-no margin work.

Fair warning though, it is tricky at first to see yourself as both high-end, moderate and generous in your pricing all at the same time.

Inconsistency isn’t a flaw, it’s a strength – you can charge properly when appropriate, then use that financial freedom to say “yes” to projects that are not immediately profitable.

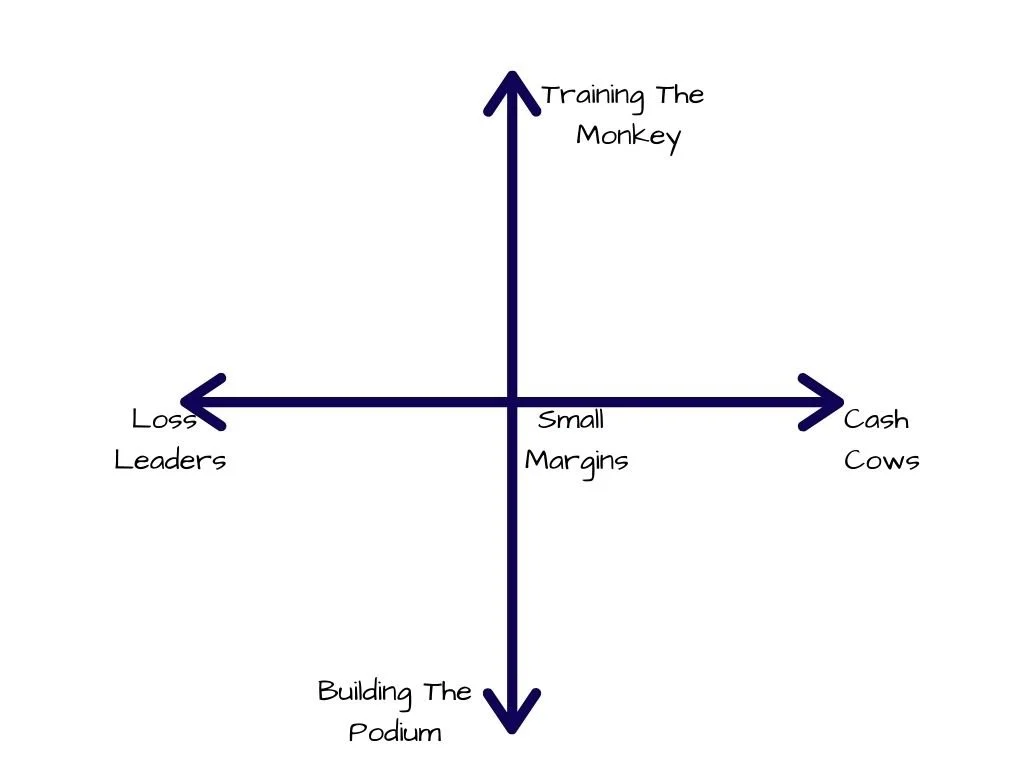

The 2x2

We can put these two spectrums together.

Vertically, the Monkey-Podium spectrum; which work is the unknown/innovative/remarkable work?

Which work is the predictable/known/standard work?

Horizontally, the Lucrative spectrum; which work is a Cash Cow, a Small Margin or a Loss Leader?

That gives us a few distinctive zones:

Chores and Headaches – projects that aren’t generating much money or doing anything overly interesting.

Paying The Bills – making a decent margin for the business, without being the most radical or transformative projects.

The Innovation Lab – trying things that might not work or make much money, but which have exciting potential and can give you a unique selling point.

Living The Dream – making good money while doing the most interesting work, the best of both. Usually temporary, sometimes competitive, but not as rare as you’d think.

So for your business, there are lots of different projects you could pursue…

Some will be easy to rule out…

Then you get to the strategic part – choosing a handful of projects as a set, which bring a sustainable income and push you into interesting places…

One Final Spectrum

The other thing to consider here is the joy in your work.

The lucrative and innovative work will sound impressive to everyone else, but it can often be the work that brings high expectations and a great tax on your emotional battery.

For that reason, it helps to plot out your draft portfolio on the Joyless-Joyful spectrum, to get a sense of how personally sustainable this work might be.

This might make you re-select one or two projects – some of the Podium Building work might be the most regenerative and engaging work, and that’s a good enough reason to keep it in your top 3-4 projects.

Principles, Not Recipes

My advice is not as clean as “have two cash cows, a small margin and a loss leader”, because there are no set recipes.

What this gives you is a language with which to describe your varied choices – which part is the hard part, how much margin does each project contribute, and will it be joyful or draining.

You get to explore lots of options with your team and with your advisors.

I suggest looking at a range of different packages, and see what stands out to you.

Maybe that involves two polar opposites, maybe that means lots of similar work, up to you.

Your portfolio of projects will also change over time, as you add/remove team members, increase your reputation and strengthen your balance sheet, or as your industry evolves.

My final tip – challenge your assumptions.

It might not be possible to have your cake and eat it too, but you might want two small cakes?

Or maybe it can be one project that does everything?

Look at your peers and your rivals – what limitations have they put on their thinking?

Why do you have to lower your hopes?

What about other industries?

How would they see your various opportunities?

What portfolios would they select?