Variable Cost Calculations

Now that we have a handle on where our money comes from, it’s time to look at where that money gets spent.

Those revenue forecasts look fantastic, but a lot of that money is eaten up by producing more goods and services.

We want to get hyper-clear on how much it costs to produce each item, because it will give us a rule of thumb for tracking our financial performance.

This is called “Cost Of Goods Sold” or COGS.

On your bank statement, your costs tend to look the same – money running out the door.

Some costs feel like a drain, such as paying your heating bill or annual registrations.

These aren’t much fun.

Others are a byproduct of good news, like needing to re-order more bubble wrap because you’ve been shipping so many parcels to customers.

These are great – every time you buy a jumbo roll of bubble wrap, you know that sales must be going well.

It also makes our bank statements look lumpy.

We spend a lot of money getting that first sale done – buying all the packaging, labels, boxes, business cards, etc, but then the next 100 sales hardly cost us anything.

Then sale number 101 comes in, and suddenly we have to buy more supplies.

Of course we know that this is terrible mental maths – in reality each sale cost us 1% of the total supplies.

That’s our challenge here in determining a variable cost formula; we need to identify all the costs involved in making a sale, then spread those costs out across all the items/services we sell.

Identifying Variable Costs

We’re looking to list all of the expenses that get used up every time a customer makes a purchase.

For an online clothes store, your variable costs could include:

· Wholesale cost of each item

· Shipping

· Receipts/invoices

· Post packs/satchels

· Pay-per-click advertising

· Staff to fulfil each order

· Credit card/payment facilities

For a café, your variable costs include:

· Bags of coffee beans

· Milk

· Pastries (ordered in)

· Ingredients (like eggs and avocados)

· Takeaway cups

· Paper bags

· Uber Eats fees

For a consulting company, your variable costs include:

· Marketing materials/brochures

· Catering

· Eventbrite fees

· Contractors

· Venue hire

It’s useful to express these in dollar terms and as a percentage.

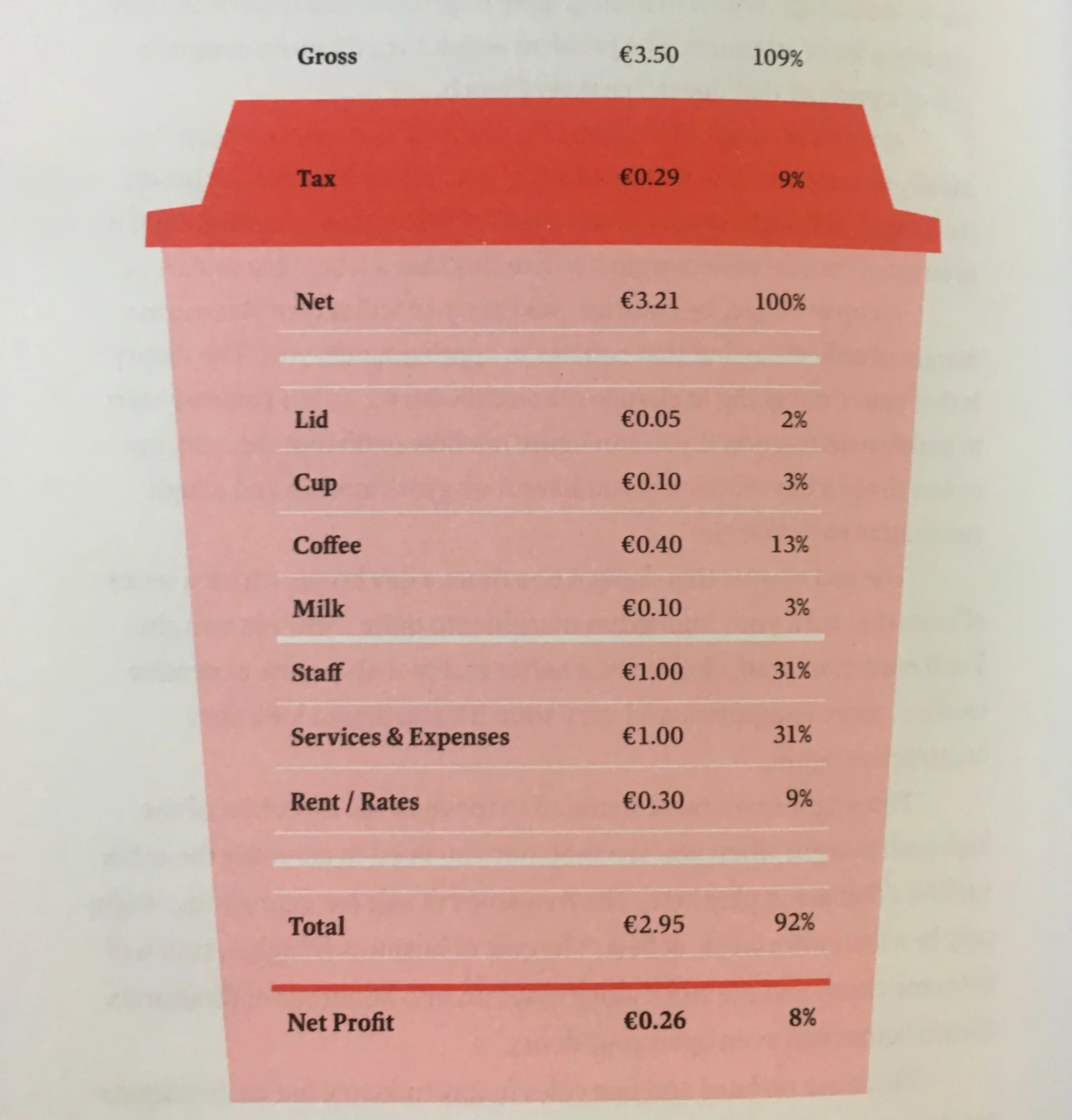

The best visual example I’ve seen is from Colin Harmon’s excellent book What I know About Running Coffee Shops:

Image Credit: Colin Harmon - What I Know About Running Coffee Shops

That’s what you’re looking to build.

By listing out how much you’re spending to create each unit, you can make quick calculations and track how the business is performing.

Identifying Averages

“Half the money I spend on advertising is wasted.

The trouble is, I don’t know which half.” – John Wanamaker

It’s tricky to calculate how much each sale costs.

You might put up an advertisement, and then have 20 enquiries, of which 12 then go on to buy something.

Your variable costs are determined by the cost per sale, not cost per attempt.

In other words, you’d be dividing the advertisement cost by 12, not by 20.

This acknowledges two trends:

1. There’s a lot of waste in acquiring customers and making products.

2. The cost of each individual input is surprisingly cheap.

It’s like when you’re gardening; you plant lots and lots of seeds, knowing that only a portion of them will grow into plants.

Since seeds are so cheap, you’re happy to plant three seeds in each hole, even though only one will flourish.

That’s the rule of thumb we’re looking for here – to attribute each plant as costing us three seeds, even though it only emerged from one.

This is the challenge of small numbers, any slight shift in sales can suddenly transform how you see the value of advertising.

For example, the campaign might look like a failure, then on the last day of the month you get a large customer.

That will completely change your calculations for the campaign – even if the large customer never saw your ad.

For this reason, the aim isn’t to precisely determine the amount you spent retroactively.

The aim is to be able to forecast how much you need to spend to acquire your next 1,000 customers.

Cherry picking nice sounding numbers makes you feel good, but if it’s a flawed measurement then you’re only deluding yourself.

Semi Fixed Costs

Some of your expenses kick in at odd times.

You might be able to have one staff member serve up to 20 clients, but when you hit 21 clients you need a second person.

The same goes for equipment, administrative support, bandwidth or customer service.

Whilst your revenues gradually get bigger, your costs hit points where you suddenly have to spend money to expand your capacity.

These are called Semi Fixed Costs, and you’ll want to identify the trigger points for expansion.

That way, when you forecast an increase in customers or revenues, you also remember to increase your forecasted expenses, since you’ll be growing your operations.

Advantages of Variable Costs

The nice part of variable costs is that you only spend money while you make money.

If there are no sales, you don’t burn your cash on unused resources (like staff time, utilities or space hire).

You literally pay for what you use, so these costs can be predicted as percentages, rather than definitive dollar amounts.

They’re also associated with costs that aren’t your speciality.

· I don’t want to set up my own payments service, so I use Paypal.

· I don’t want to cater for my own workshops, so I use Kinfolk.

· I don’t want to pick which web pages to advertise on, so I use Google Adwords and pay per person who clicks on my ad.

There are cheaper ways to do each of these, but they’re far more time consuming.

I’d rather just pay for what I use, and not worry about saving a few dollars in exchange for some big headaches.

If you’re starting a new business, you’ll have less financial pressure and wastage by turning fixed costs into variable costs.

Disadvantages of Variable Costs

Generally, things are cheaper when you buy in bulk.

If you know that you’ll be consistently using a person/item/service, it’s probably cheaper to buy it outright.

e.g. hiring an accountant or lawyer rather than paying their expensive day rates, or leasing an office rather than paying weekly co-working fees.

Renting is more expensive than owning – in the long run – and it provides more flexibility.

If you know what you’re doing, you’ll get more value for money by turning variable costs into fixed costs.

For your business, it’s worth listing out the top seven variable costs you expect to incur with each transaction.

If you have a more complex item (like calculating the price of a coffee), take the time to identify a per-cup costs and use it as a rule of thumb.

Once you’ve tallied them up, you’ll have a dollar figure and percentage of COGS for each product/service.

This leaves you with the “gross margin” – the amount you have left to cover your fixed costs.

In the next article, we’ll take a closer look at how your fixed costs stack up…