How To Get Good With Your Personal Finances

“Money can’t buy happiness, but money buys me freedom and choices.

And freedom and choices bring me happiness”

– Dave Chappelle

A lot of my friends ask me about how they can get good with money.

Personal finance is such an interesting topic – it affects how many of your favourite things you can do, and a bit of thought now can save you a lot of stress in the future.

People come to me because they heard about “your weird system with all those bank accounts that’s apparently good”

Obviously, I am not a financial advisor, and this is not tailored financial advice.

These are my opinions, and they reflect a system that works really well for my circumstances, and yours might be different.

It’s easy to get spooked by financial terminology, but the core principle here is simple:

Budgeting is a fancy word for planning.

Planning is a fancy word for guessing.

So when we talk about budgeting, we’re really making a guess:

How can I use my money in a way that makes me happiest?

People think that budgeting means not spending money, but that’s not true.

If you get your act together, you can do the things that make you happy whilst also building your wealth.

This comes back to the principle of “anything vs everything”.

You can afford to buy almost anything you want, but not everything you want.

My friend bought a BMW when he was a uni student, funded by his job at the cinema.

He spent almost all of his money on running and repairing the car – and nothing on travel, clothes or eating out.

This example might sound great or tragic, depending on your perspective.

That’s why your own finances are interesting; because you get to decide what is important and what isn’t.

You’re going to earn a lot of money over the next 40 years, and have the potential to do some incredible things, like travelling the world, driving your dream car, building/buying a house, working in a job that you find fulfilling, wearing designer clothes, or donating large amounts to causes close to your heart.

The catch is, you can’t do all of those at once.

You’re going to have to prioritize the things that you love the most.

This is where money comes in.

Money can make things happen, but it needs to be directed.

“The value of a budget is that it tells you where you want your money to go, rather than wondering where it went”

So how do I direct my money?

The first thing we need to do it to get some clarity.

Let’s say you have $5,000 in the bank.

Your friends invite you to go to Byron Bay with them for a week – and you’re keen.

Can you say yes?

I have no idea.

Neither do you.

It depends on your circumstances.

What else does that $5,000 need to do?

Is it your life’s savings?

Do you have to pay your rent tomorrow?

Is your car registration due next week?

Have you been saving for a holiday for a while?

It might be that your bills are all paid and you’re happy to spend this money on something wonderful – like this trip.

However, it might also be that you have $2,500 worth of bills coming up, plus you promised your cousin you’d go travelling with her in four months’ time and need to save up.

This is the problem with only having one bucket of money: even when it looks full, we still don’t really know what we can do with it.

Our money has different purposes.

Some money is set aside for our basic bills

Some money is saved for a rainy day

Some money is for Christmas presents

Some money is for groceries

Some money is for little indulgences like concert tickets

Some money is for a new computer for university, because your current one is about to die

What we need is a system that splits our money into its respective purposes, so that we can see how each purpose is doing.

That way, we don’t overspend, nor do we feel guilty when treating ourselves.

I use a system that is a combination of several expert’s advice (Dave Ramsay and Scott Pape), and it works brilliantly.

It works like this:

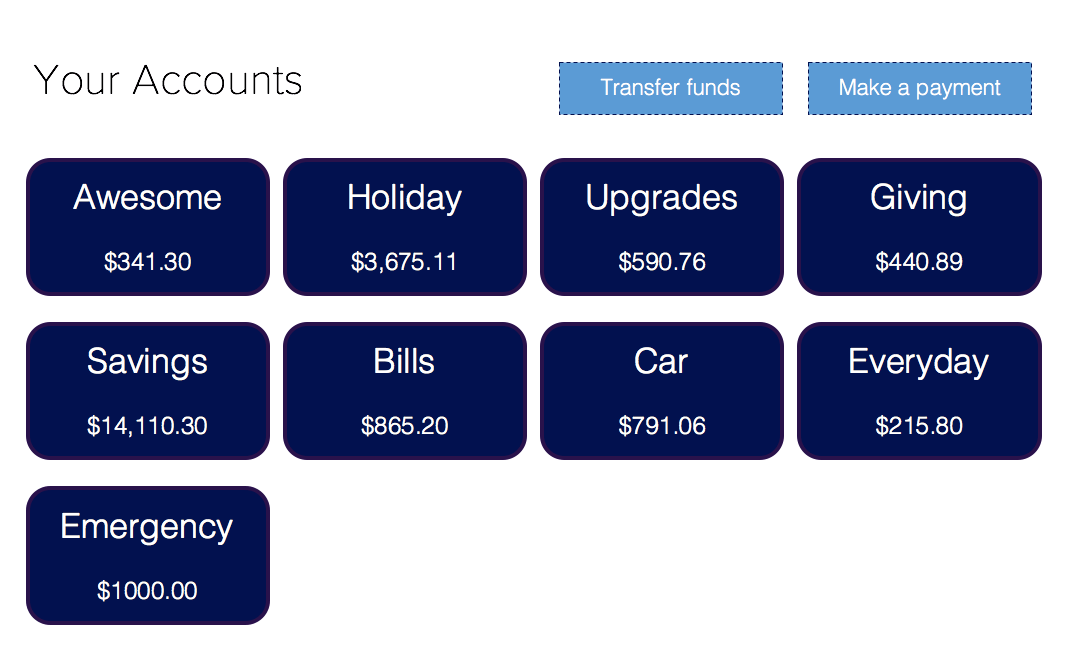

We create nine different buckets of money – each bucket has its own purpose.

Because they’re separate, we can be simultaneously putting money aside for the future, for a holiday, for bills, and still be able to buy treats like shoes or brunch.

Best of all, you get to choose how much of your income goes into each bucket, based on what things are most important to you.

I am not one of those people who insists that you save every penny and never do anything fun.

I’m also not promising that you’ll get rich quick.

Instead, this is a way of removing financial anxiety, ensuring you always have enough money in your account for the short and long term.

Therefore, we have three types of buckets.

The Life Administration buckets make being an adult easier, making sure you’re never caught short.

The Sensible buckets help you save for the future, as well as for any emergency situations that pop up.

The Fun buckets enable you to do cool things that make you happy.

The combination of all three removes anxieties like “Will my card get declined?” or “What if my car breaks?”, as well as the guilt of “I can’t buy this, I’m supposed to be saving”.

Let’s look at them in more detail:

The Life Administration Buckets

These three accounts make your personal finances easy – by ensuring that you never need to worry about having empty bank accounts.

Bills

I have a bunch of direct debits that come out of my account each month – rent, electricity, water, internet, phone, Netflix, Spotify, etc.

Let’s say these add up to $1,900 per month.

Here’s what I do:

Every fortnight, I transfer $1,000 of my pay into my bills account.

In a typical month, $2,000 goes in, and $1,900 comes out.

That way, a buffer builds up.

Better yet, about twice a year I get paid 3 times in one month, so I’m putting in $3,000 and still taking out $1,900.

This is great, because I can then use that extra money for “surprise bills” I forgot about, like an annual gym membership.

This account is purely online – so I don’t use it for things like the supermarket. That’s the job for…

Everyday

These are the mundane, spontaneous purchases you make with your debit card, like for the bus, lunch, or maybe even a date.

We want to keep ~$500 on this card as a baseline, so that you can pay for things without needing to shuffle money around. Then each fortnight, we add $300 and aim to spend $270, so that this buffer builds up over the months.

Buffers are great for when you want to chip in for a friend’s birthday, pay for parking or want to order an extra-large popcorn at the movies.

Bills and Everyday are separate, because we don’t want our rent being deducted to leave us stranded at the checkout, or for an unexpected purchase with our debit card leading to our rent overdrawing our account.

Car

Cars are a huge financial drain, and one that tends to sneak up on you.

How much does your car cost you each week?

Maybe you drive a fair bit, so you spend $40 on petrol.

But what about your insurance?

That might be $1,000 plus another $800 for registration.

I found my servicing and repairs were averaging $1,200 a year, on a car worth only $4,000.

That’s $2,000 (fuel) + $1,000 + $750 + $1,100 = $4,850

In other words, we know there will be $5,000 worth of expenses, but are somehow shocked when the big ones are suddenly due.

The solution?

Put the money aside each week, in this case $90-100 (or $180-200 per fortnight).

That way, when insurance is due, you can take it out of the stack that’s been accumulating in the Car account, instead of suddenly eating canned food for a month.

The Sensible Buckets

These two buckets are good for you, like eating your vegetables.

At no point do I assume you’ll enjoy them, but in the future you’ll be glad that you started early.

In fact, watching them pile up is quite satisfying, and instils a certain confidence that will help you sleep at night.

Savings

You’re going to earn a staggering amount of money over your career – 40 years multiplied by any salary is a huge amount.

For example, at $60,000 per year, that’s a total of $2.4 million going through your fingers.

Lots will go to tax, then rent/housing, bills, school fees, etc.

But your savings also go up over time, thanks to compound interest in your bank account.

Interest grows your savings over time, so it’s good to start early.

More importantly, it’s important to build the habit of saving money early.

If you transfer your savings out as soon as you get paid, you won’t miss it.

As your earnings go up in the future, keep the same percentage going towards long term goals (cars and holidays don’t count), and you’ll gradually build an impressive amount in your savings account.

This can then be used as a deposit for a property, or to buy other investments like shares.

Either way, having cash in the bank is great for reducing anxiety and inadequacy.

Emergency Fund

I’ve never heard anyone put up an objection to this:

You put aside $1,000 in an account, called “Emergency Fund”.

Then you carry on with your life.

When you need to suddenly fly somewhere for a funeral, or have a pipe burst in your apartment, or need an after-hours locksmith, or have a car accident, this money gets you out of trouble.

Then you add $20 a week back into the fund until its full again, ready to cover your butt when disaster strikes.

I’m fully aware that this money could earn a fraction more if it was locked into a term deposit, and I do not care.

This account will bring you peace of mind, and means when you’re dealing with a horrible decision you’re not also focused on “how will I pay for this?”

The Fun Buckets

People tend to like this part.

Since you’ve got their Life Administration and Sensible priorities covered, you can enjoy these next four guilt-free.

Awesome

Sometimes you want something that is impossible to justify.

You don’t need it as such, or you could technically “make do” with a cheaper version.

That doesn’t stop you thinking about it all day, because you know it would make you irrationally happy.

I’m talking about buying a $60 foundation, a $300 jacket, tickets to see Adele, expensive dinners with friends, authentic Ugg boots and other luxuries.

It’s important that you never fully remove these from your budget.

Even if it’s only $10 per week, it’s vital that you feel like you can have treats – but only the ones that make you happiest.

Never let anyone question or criticize the things you buy with this money.

Since you’re already saving money and covering all your bills with the other buckets, the sole purpose of this cash is to increase your overall happiness.

Holiday

Some people think travelling is overrated.

I suspect those people have been travelling to the wrong places.

Maybe Paris isn’t for you – what about hiking through Yosemite?

White sand beaches?

Walking tours through Berlin?

Authentic Thai food up in the mountain villages?

Going to see your favourite artists on tour?

Tickets to a home game of your favourite team?

There is something out there that will bring you a lot of joy.

These trips are expensive and worthwhile, so you’re wise to start saving up even before you’ve picked a destination.

This way you can save for a holiday and for investments simultaneously.

It might take a few years to build up, but once you have a few thousand dollars in there the planning becomes a lot of fun.

Upgrades

At this point in life, you probably have the basic version of most things.

No judgement, K-mart and IKEA are great.

There will come a point where the basic version isn’t good enough – particularly with the things you use every day.

It’s different for each person, but I bet you already know the things that annoy you.

Upgrades is the account we use to buy better versions of important things.

It might be a new couch, a well-designed pillow, a good blender, speakers for your lounge room, etc.

Gradually, you’ll continue to have better versions of the things that matter most, whilst still keeping your IKEA bookshelves.

People usually forget about these purchases, then get annoyed that they have no money to buy nice things for their apartment.

By setting aside a little each week, you’ll enjoy the feeling of being able to buy whatever you like.

Giving

What makes you angry in life?

Inequality?

Poverty?

Animal rights?

Social justice?

We each have causes that are important to us.

Unfortunately, thinking nice thoughts doesn’t do much for solving real world problems.

It’s good to build the habit of funding the things that matter to you, and breaking the illusion that you need every cent you earn in order to survive.

By allocating money each week, you have the ability to support good causes when you see them, without it ruining the rest of your buckets.

Interestingly, you won’t miss the money – by putting it aside when you get paid, it no longer feels like a loss when you give it away.

OK Isaac, what do I do first?

The first step is to draw out your buckets on paper or a whiteboard.

Start with the minimum amount in each, then you can allocate your remaining money into the buckets that will make you happiest.

This is where tradeoffs come in:

Would you rather save more, or have more meals out?

Would you rather more money for treats, or travel sooner?

Would you rather a more expensive phone plan, or a new mattress?

There are no wrong answers here, just the choices that are right for you.

The important thing is that you recognise the tradeoff, and are happy with saying no to lots of offers in order to say yes to the best ones.

How do I use buckets in the real world?

I’ve found the best method is to use free online bank accounts.

This allows you to make quick transfers with your phone, and view all of your buckets of money on the same screen like this:

This way, you have clarity over where your money is going, and can make good decisions very quickly.

When you get paid, simply make the transfers into each bucket.

e.g. $20 to Awesome, $130 to Savings, $80 to Car, etc.

This is surprisingly fast – it’ll take you roughly 90 seconds each time you get paid.

If anything, it makes payday boring, since you never have to worry about having enough in each account.

That’s what financial peace is like: by creating a good system, you end up thinking less about money.