Cashflow, Profit & Loss and Balance Sheets

One of the challenges with finance is that we have boring, generic ways of describing useful, complex ideas.

This is certainly the case for the three types of financial statement;

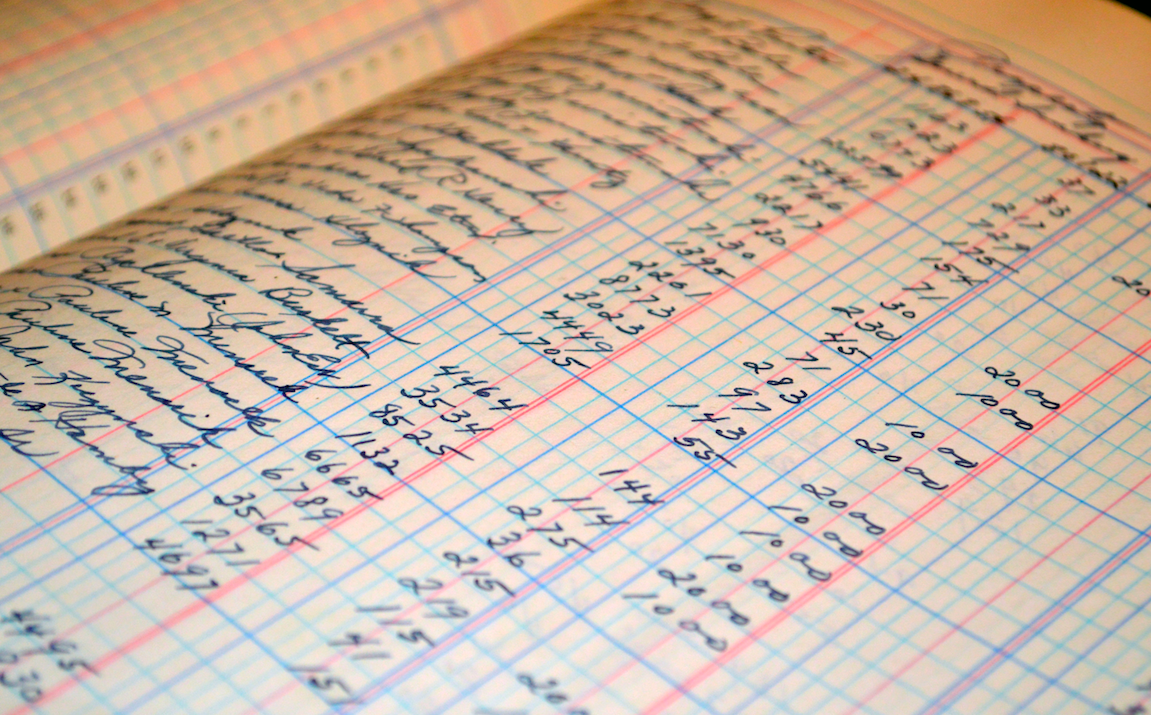

A cashflow, profit & loss and balance sheet all look the same on paper.

When you read the descriptions of what they each mean, you’re often none the wiser.

That’s a shame, because they each tell you different things that could save you a lot of trouble down the road.

Here’s how I think about it:

Let’s say you’ve committed to getting healthier.

You’re sick of eating junk food and feeling awful, and in a burst of motivation, you’ve asked your friend to keep you accountable.

One month later, you and your friend do a review to see how things have gone.

Your friend asks you about three different things:

1) Can I see your receipts from the supermarket and bank statement?

What food and drink have you been buying and what exercise equipment have you bought?

2) What have you eaten, and what exercise have you done?

3) Have you gained or lost fat? Have you gained or lost muscle? Has your weight increased or decreased?

These are excellent questions, because they each capture different things.

Firstly, by looking at your receipts, you can see how much takeaway you’ve bought versus fruit, vegetables and protein powder.

Secondly, by tracking what you’ve eaten and what exercise you’ve done, you can identify which days were good or bad.

Thirdly, by measuring yourself you can tell if the new regime has been effective.

This approach is brilliant for determining what’s going wrong.

For example, if you buy no healthy food, how will you expect to change your behaviour?

Alternatively, you might be buying all the right foods, but then letting them pile up in your cupboard while you eat the 10-pack of noodles you already owned.

Maybe you’re following your plan to the letter, but aren’t seeing any visible progress in your when you look in the mirror each day.

The results tend to flow through each stage.

If you buy good things, you’re likely to then use them/eat them.

If you eat the right things and exercise regularly, you’ll gain strength and burn fat.

If you do this consistently, you’ll notice a difference in your body and your mood.

If your supermarket trolley is full of junk food, you can guess which way you’re heading.

Owning an AbMaster Pro doesn’t change anything if you don’t use it.

And even the best programs won’t make you lose 15kg in one week.

This is what we’re trying to capture with our three financial statements – three different dimensions that help us identify what’s really going on.

A Cashflow is the tally of where dollars come in, and where dollars go out.

We can use it to see how money flows in and out of the business – is it consistent, or feast and famine?

A Profit and Loss is where we track what costs incur, and how our income is earned.

It allows us to see the “theoretical money” that hasn’t hit our bank account, like invoices that haven’t been paid.

A Balance Sheet is a tally of all the things we own, minus the debts we owe, and the amount that’s left over.

It’s a moment frozen in time, which lets us see how much equity/value is sitting in the business.

If you only look at one of these statements, you might miss the real story.

Let’s say you are a freelancer, and this week you’ve spent 50 hours on paid client work.

You’ve worked hard, and for a good rate.

However, you won’t get paid for another three weeks.

Has it been a good week?

Alternatively, let’s say you’re a business owner and haven’t needed to spend much money – sales are slow so you’ve been using up a lot of the stock in your inventory.

Has it been a good week?

A startup might be making a lot of progress with customers who are promising to sign up, but if it runs out of cash, game over.

A department store might be making good sales, but their assets (inventory and equipment) are quietly losing value every year, which could leave them with an overall loss.

A cashflow might tell you that you spent $70 to fill a $100 order.

A Profit and Loss then breaks down how much of that $70 was on cost of goods versus overhead costs – which can be a huge red flag.

What about your non-cash expenses like depreciation?

It might not be a payment, but it’s certainly an expense that needs to be monitored, otherwise you’ll be stunned when a valuable item suddenly needs to be replaced.

If you measure purely the money in and money out, you’ll get the wrong impression.

If you look at the overall position of your business, you get a better idea.

That’s the benefit of seeing the full picture – you can spot problems in advance.

If there are cashflow issues, you can change your pricing structure.

If your costs are rising faster than your revenues, you can change your business model.

If your assets are shrinking and your debts are rising, you can restructure your company or find a good partner.

Numbers are open to interpretation.

Some people will see that a business has very little cash on hand, and they’ll be pleased – they’d rather that spare money was re-invested in the business so it grows faster.

Others see the same situation and become concerned – the business might not be able to cover an unexpected expense.

Either way, having these different tools gives us a better sense of the health of the idea.

It equips the team to have a good debate about what to do next, and what changes need to be made.

If you’re new to this sort of thing, the first thing to do is try and build your own version of each of these – they will be terrible but it’ll highlight the gaps in your knowledge.

If you’re struggling with the terminology, go to Investopedia, it’s a great resource with plain English explanations.

Finally, don’t be embarrassed to start from the absolute bottom: I found the book Accounting For Dummies was the best teacher for building each of these statements step by step.

If you can’t read your own financial statements, you’re flying blind.

You’ll miss the golden opportunities, as well as the early warning signs.

And ultimately, you’ll end up doing less of the work you love.